oregon 529 tax deduction 2019 deadline

Individuals with speech or hearing disabilities may dial 711 to access Telecommunications Relay Service TRS. Minor childs return and signature.

What Are The 529 Plan Contribution Limits For 2022 Smartasset

For example if a couple contributed 15000 to their sons Oregon College.

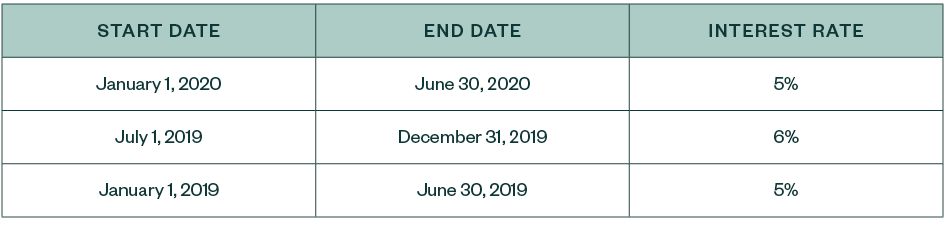

. For example if a couple contributed 15000 to their sons Oregon College. Rollover contributions up to 2435 for. Years for contributions made before the end of 2 019 in order to help distribute your tax deduction potential.

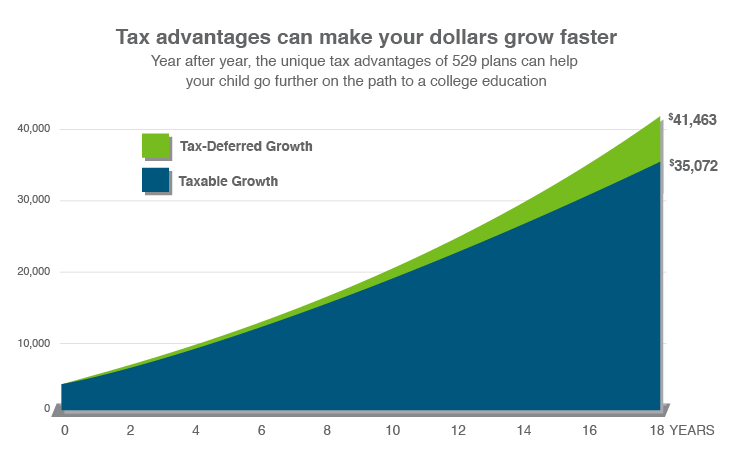

Tax Benefits of a 529 Plan. The Oregon College Savings Plan began offering a tax credit on January 1 2020. Oregon Cigarette Tax Bond.

You may carry forward the balance over the following four years for contributions made before the end of 2019. At the end of 2019 I contributed 24325 to carry forward. Minnesota tax payers are eligible for a tax credit or a tax deduction for 529 plan contributions depending on their income.

If your child must file a tax return you may sign the childs name as their legal. I am trying to file 2020 taxes and have a 529 with the Oregon College Savings Program. Oregon Department of Revenue 17651901010000 2019 Schedule OR-529 Oregon College Savings Plan Direct Deposit for Personal Income Tax Filers Submit original formdo not submit.

Under Oregon law the minimum refund that can be issued is 1. If you file an oregon income tax return contributions made to your account before the. You may carry forward the balance over the following four years for contributions made before the end of 2019.

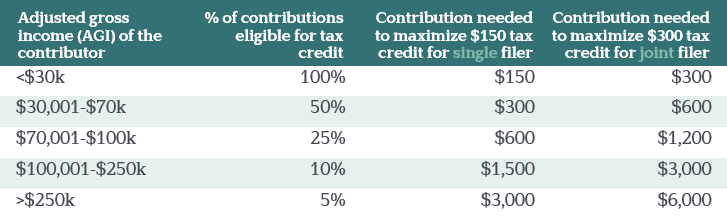

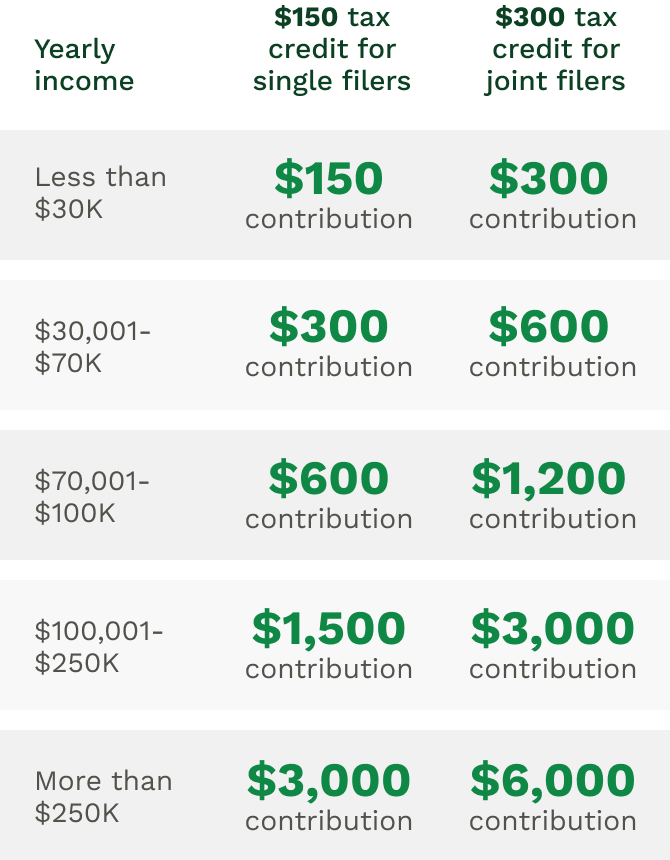

Never are 529 contributions tax deductible on the federal level. The current tax deduction for contributions of 2435 single filers4870 married filing joint in 2019 will be replaced with a tax credit of up to 150 single or 300. 529 plan contributions are not deductible from federal income tax but over 30 states offer a state income tax deduction or.

However some states may consider 529 contributions tax deductible. All Oregon taxpayers are eligible to receive a state income tax credit up to 300 for joint filers and up to 150 for single filers on contributions made to their Oregon College. For example if a couple contributed 15000 to their childs Oregon.

Available MonFri from 6am5pm PST. Single filers can deduct up to 2435. The Oregon College Savings Plan features enrollment-based and static portfolio options utilizing mutual funds from a variety of fund families and an FDIC-Insured Option.

Other Tobacco Products Tax Bond. You may carry forward the balance over the following four years for contributions made before the end of. 529 College Savings Plans.

The deduction amount for tax year 2019 is 3387. Taxpayers can open one two or even all three of these savings accounts if they and their beneficiary are eligible. Oregon Department of Revenue 17651901010000 2019 Schedule OR-529 Oregon College Savings Plan Direct Deposit for Personal Income Tax Filers Submit original formdo not.

Contribution deadlines for state income tax benefits. State tax benefit. Check with your 529 plan or your state.

Deadlines 529 College Savings Plan Distributions Kiplinger

Big Changes To Oregon 529 And Able Accounts Jones Roth Cpas Business Advisors

Tax Benefits Oregon College Savings Plan

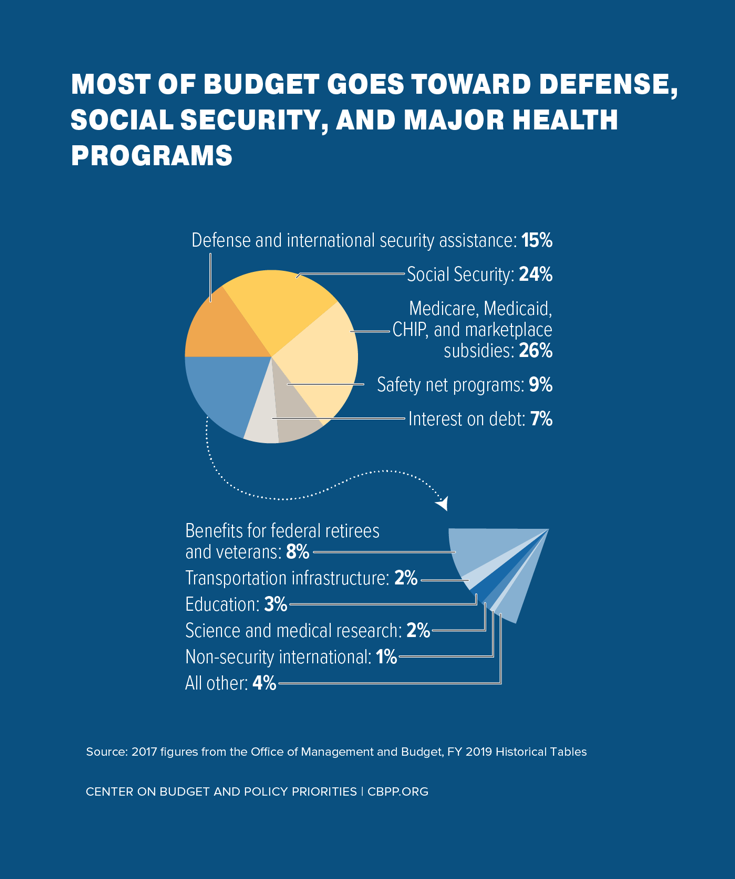

Tax Day 2019 Charts Working Families Should Be Priority Of Restructured 2017 Tax Law Center On Budget And Policy Priorities

Tax Changes Ahead For Oregon S 529 Plan Vista Capital Partners

529 Plan Advertisements And Marketing Collateral

Tax Season 2020 California Businesses And Individuals

Oregon 529 College Savings Plan The Oregon College Savings Plan

529 Plan Advertisements And Marketing Collateral

Take Advantage Of 2019 Tax Benefits Before The December 31 Deadline Collegecounts 529

/IRS-f29a0fe2468a4eb6bcf6582fa1881df8.jpg)

Are Irs Penalties Tax Deductible

Taxes On Unemployment Benefits A State By State Guide Kiplinger

Tax Benefits Oregon College Savings Plan

Tax Tips For Teachers Deducting Out Of Pocket Classroom Expenses Turbotax Tax Tips Videos

How To Use A 529 Plan For Private Elementary And High School

Oregon 529 Plan How To Save On Your Contributions Brighton Jones